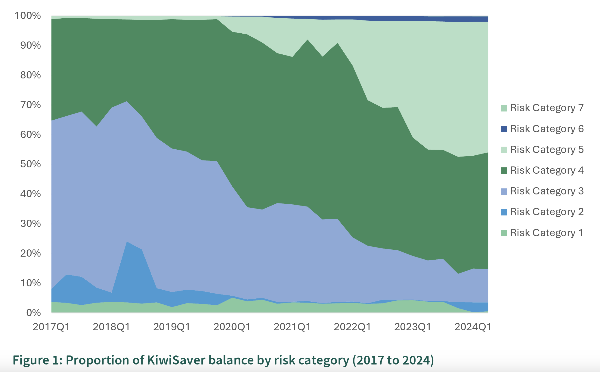

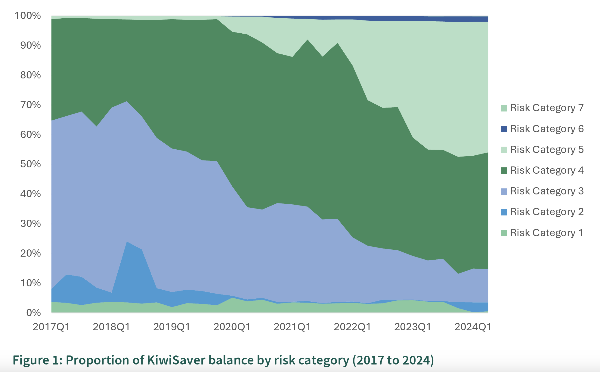

In an Occasional Paper Series the regulator has observed a dramatic increase in the overall risk categorisation of KiwiSaver funds in recent years.

"The proportion of KiwiSaver invested in risk category 5 funds (high volatility) has quadrupled from around 10% in 2021 to more than 40% in 2024, with the proportion in risk category 3 funds (low to medium volatility) decreasing from 30% to 10% over the same period."

While it does not say whether that is a good or a bad thing it does try to understand the reasons for this shift.

Fisher Funds general manager KiwiSaver David Boyle says, "we think the increase in the amount of KiwiSaver funds invested in higher risk funds is a good thing for investors seeking to grow their retirement savings over the long term."

He says KiwiSaver has turned 18 this year and it – and investors – are maturing. He says there are six things worth noting:

- Greater saver sophistication: consumers know more about the role of growth assets for a long-term savings scheme like KiwiSaver

- Better education: Fund managers are responding to consumer interest and providing education on the risks and benefits of different fund types.

- We’ve weathered storms: consumers have seen the impact of market events like the GFC, Covid and more recently the impact of tariffs. They have seen markets bounce around the generally rally and recover.

- The democratisation of investing: the advent of platforms that allow investors to build their own portfolios allows providers to launch single sector specialist offerings that are often at the riskier end of the spectrum.

- New asset classes: like our own private equity strategy increases risks, but offer the potential for better long-term outcomes when prudently introduced into diversified portfolios

- Low risk choice abounds: Members still have the choice from many lower risk funds and savings options which may hold appeal for those decumulating funds as they enjoy their retirement years.

Search

Search