Key market movements

Global equities rebounded strongly in May, posting a return worthy of top decile historically, at 5.1% in unhedged NZD terms, and 5.6% NZD-hedged. Broadly, most sectors were positive, with healthcare an outlier at -3.7% and information technology leading the pack at +10.3%.

Locally, the New Zealand equity market also bounced back with the S&P/NZX 50 Gross Index (including imputation credits) delivering a 4.3% return, whilst Australian equities also performed well with the S&P/ASX 200 Index up 4.2% (4.1% in NZD terms).

NZ bond returns were negative in May (-0.4%), measured by the Bloomberg NZ Bond Composite 0+ Yr Index. Global bonds also had poor performance with the Bloomberg Global Aggregate Bond Index (NZD-hedged) returning -0.4%. After a volatile month for US Treasury Bonds the 10-year yield had increased 24bps to 4.40%. New Zealand 10-year yields ended at 4.57% after a smaller increase.

Key developments

May saw significant developments in global trade, particularly around Trump’s tariff policies, whilst monetary policy was also in the spotlight. Early in the month, markets reacted to a potential US-UK trade deal and ongoing concerns about US tariffs, which were projected to substantially increase the effective tariff rate in 2025. The US Federal Reserve kept interest rates unchanged at 4.25-4.50%, noting a "solid" economy despite rising risks of higher unemployment and inflation. Later in the month, a substantial drop in US-China tariffs led forecasters to revise upward US and Chinese economic growth projections. However, US inflation remained a concern, with most forecasters expecting it to rise, potentially limiting the Fed's ability to cut rates. The US House passed a tax bill extending 2017 tax cuts, estimated to add significantly to national debt and drawing concern from the bond market.

New Zealand's economic landscape in May presented a mixed picture. The Q1 unemployment rate remained at 5.1%, driven by a surprising drop in participation, and wage growth was softer than RBNZ expectations. This kept the RBNZ on track for a 25bp rate cut later in the month, with forecasts for the OCR to reach a sub-3% low. The NZ Budget was cautious, confirming an intent to reduce deficits and return to surplus by June 2029, with Treasury revising down near-term growth forecasts due to tariffs. The RBNZ delivered the expected 25bp rate cut at the end of May, though post-statement commentary suggested increased caution about future cuts, leading to a rise in bond yields and the New Zealand dollar.

The global share market experienced a significant rebound in May, with the MSCI ACWI and S&P 500 closing the month up 17% and 19% off their April lows and approaching all-time highs. This positive movement was supported by favourable trade announcements, improving real-time US GDP measures, and a strong US earnings season, particularly from the Communications Services sector. Despite concerns about the impact of tariffs on earnings and confidence, market sentiment improved. Nvidia's quarterly earnings provided a notable highlight, with a beat on earnings and an upbeat sales forecast despite new export restrictions, further fuelling the stock's rally and reinforcing the market's optimism around AI.

The Australasian share markets saw varied performance and key company updates throughout May. The Sydney Macquarie Conference provided insights into the Australian economy, with many growth companies reiterating earnings guidance and some consumer sector companies expressing more positive spending trends. Companies like Contact Energy, Manawa Energy, and Infratil saw positive market reactions to a Commerce Commission approval. However, Sky City issued its third earnings downgrade, and Fletcher Building provided an unexpected trading downgrade. Xero and Life360 reported strong results, while Serko and Gentrack initially disappointed. Major New Zealand companies like Fisher & Paykel Healthcare and Infratil delivered strong annual results, and Mainfreight's management was surprisingly positive about current trading in Australia and New Zealand.

What to watch

Source: Bloomberg, Harbour Asset Management

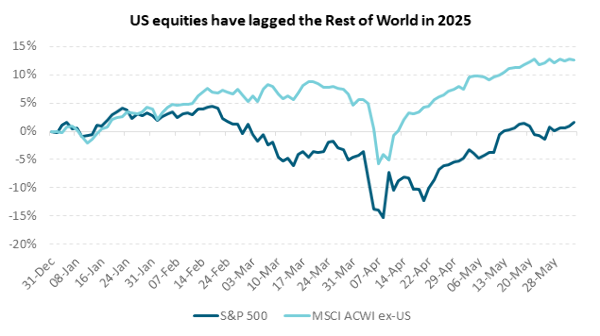

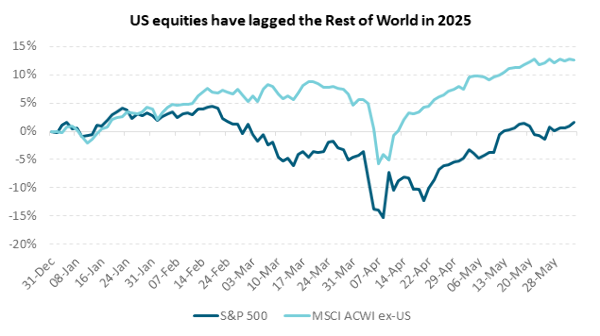

Amidst a recalibration of global market dynamics, the narrative of US share market exceptionalism has seen a notable shift in early 2025, while new strengths emerge elsewhere. Investors, previously accustomed to American dominance fuelled by tech innovation and robust domestic demand, are now increasingly acknowledging China's growing credibility as a formidable AI player. Breakthroughs from Chinese AI labs, particularly in open-weight and non-reasoning models, have demonstrably narrowed the performance gap with US rivals, with companies like DeepSeek making significant strides and contributing to substantial user growth. This technological ascent is bolstering market confidence in China's long-term growth prospects, despite lingering concerns about trade tensions and domestic economic challenges. Concurrently, European markets have been positively buoyed by a renewed commitment to fiscal stimulus, as exemplified by Germany's substantial corporate tax relief package and broader EU initiatives aimed at bolstering infrastructure and defence spending. These themes, coupled with the uncertainty around US trade policy, has seen investors hunt for value outside the US so far this year.

Market outlook and positioning

With the substantial drop in tariffs on US-China trade, a US recession is now unlikely. China has reduced its 125% tariff on US imports to 10% and the US has reduced its 145% tariff on China imports to 30%. The Budget Lab at Yale University estimate the effective tariff on US imports has dropped to 17.8%, from 27.6%, and after consumption shifts will be 16.4%. It appears most economists assume the US effective import tariff will settle between 12 and 17% which implies a decent hit to US growth but no recession. Growth forecasts for these countries look to have landed 0.5-1.0 percentage points higher than previous estimates, for instance the US may grow around 1.0% this year and China just above 4.5%.

It appears Europe is now in the crosshairs with Trump promising 50% tariffs on EU goods from 9 July. This is likely a negotiating tactic, but the market is rightly taking notice as the EU is the United States' largest trading partner by imports, worth US$606bn in 2024.

The US House of Representatives passed President Trump’s tax bill in May, but markets are concerned about the funding. The bill extends Trump’s 2017 tax cuts with very little offset from reduced spending. If passed by the Senate in its current form, the non-partisan Committee for a Responsible Federal Budget estimates that the legislation will increase US national debt by more than US$3.3trn over the next decade, taking government debt from 98% of GDP to a record 125%. The bond market is keeping a wary eye on progress. Following Moody’s recent downgrade of the US sovereign credit rating from Aaa to Aa1, recent price action indicative of a market that is willing to impose higher borrowing costs on the US economy to reflect deteriorating fiscal sustainability.

Despite downside risks to trading partner growth from tariffs, our export sector is currently enjoying the enviable combination of high global prices and solid demand. Dairy makes up 30% of our total goods exports and it’s been a bumper season for this sector with a record-high Fonterra forecast milk price of $9.70-$10.30, which may have further positive momentum given recent whole milk price powder auctions. Other primary sector exporters are also doing well with meat and timber, which together make up 20% of goods exports, enjoying the highest annual revenue for two years. For now, however, lending data suggest that most of the additional revenue is being used to pay down debt after two tough seasons, rising farm costs and a highly uncertain global outlook.

The NZ Budget was a cautious one, confirming an ongoing intent to reduce deficits and return to surplus by June 2029. This means the average fiscal impulse over the next four years remains negative and likely places more pressure on monetary policy to support the economic recovery. Debt Management increased the bond programme by $4bn over the next four years, which was within market expectations, but this was concentrated in outer forecast years with the next two years seeing a reduction in planned issuance. This was received well by the bond market.

The RBNZ delivered the expected 25bp rate cut to 3.25% in May but the communication incorporated some less dovish elements. The Monetary Policy Statement showed continued anticipation of more rate cuts to a forecast OCR low of 2.85% given large amounts of spare economic capacity and inflation that reaches target early next year. However, a dissenting vote that preferred to leave the OCR unchanged, and the removal of an easing bias according to Governor, Christian Hawkesby prompted a tightening in monetary conditions. Markets are still looking for another rate cut later this year, and we continue to anticipate two, taking the OCR to 2.75%.

Within equity growth portfolios, strategy remains to be patient, position for a range of scenarios and to be selective, focusing on quality growth. We continue to focus on companies delivering earnings per share growth, particularly where that earnings growth has the potential to be higher and last for longer than consensus expectations allow for. We continue to see the secular (less dependent on economic activity) tailwinds of digitisation, disruption, de-carbonisation, and demographic changes as supporting company earnings. Portfolios are overweight relative to the benchmark in investments with secular tailwinds in the defensive growth healthcare sector and the higher growth information technology sector, where supported by strong cashflows. Portfolios are also overweight in selected materials and financial shares that benefit from structural change and have pricing power. Portfolios also remain underweight in the lower growth utilities, telecommunications, real estate and infrastructure sectors.

In fixed interest, despite ambiguous messages from the RBNZ at the May MPS, which pushed front-end rates higher, we continue to expect the OCR to reach 2.75%. This sits below market pricing, and we are overweight at the front of our yield curve. Globally, concerns about US fiscal sustainability have increased longer-dated US yields and influenced most developed bond markets, including NZ. But these worries appear better priced now. 10-year UST term premia have risen from less than 40bp in early April to around 60bp now and the US yield curve has steepened considerably. An evolving shift in policy at the Bank of Japan is adding to upward pressure on global long-term yields. Different to the US, our government is showing fiscal restraint and a reduction in bond issuance over the next two years was revealed at the recent Budget. With our 10- to 30-year yields sitting higher than the US and our yield curve steeper, we are comfortable to be overweight in the 10-year+ part of our curve.

Within the Active Growth Fund, we hold a neutral position to equity markets as we see the balance of risks as being reasonably equal. We remain wary of valuations which point to below average long-term returns; however, earnings momentum remains strong and investor sentiment and positioning remains dour, despite the recent rally in markets. Currency wise, we are hedging more of our global equity holdings than the benchmark. The USD is richly valued on long term fair value models (though not according to our short-term models) and many of Trump’s policies have the potential to be US dollar negative and have heightened the risk of capital flows away from the US dollar. This was a high conviction position in April, but as the NZD has marched towards 60 US cents, we have reduced our position.

---

IMPORTANT NOTICE AND DISCLAIMER

This publication is provided for general information purposes only. The information provided is not intended to be financial advice. The information provided is given in good faith and has been prepared from sources believed to be accurate and complete as at the date of issue, but such information may be subject to change. Past performance is not indicative of future results and no representation is made regarding future performance of the Funds. No person guarantees the performance of any funds managed by Harbour Asset Management Limited.

Harbour Asset Management Limited (Harbour) is the issuer of the Harbour Investment Funds. A copy of the Product Disclosure Statement is available at https://www.harbourasset.co.nz/our-funds/investor-documents/. Harbour is also the issuer of Hunter Investment Funds (Hunter). A copy of the relevant Product Disclosure Statement is available at https://hunterinvestments.co.nz/resources/. Please find our quarterly Fund updates, which contain returns and total fees during the previous year on those Harbour and Hunter websites. Harbour also manages wholesale unit trusts. To invest as a wholesale investor, investors must fit the criteria as set out in the Financial Markets Conduct Act 2013.

Search

Search