Barfoot & Thompson’s latest data shows that Auckland’s average price hit $906,560 in August, which was up from $867,681 in July.

The city’s median price was up to $850,000 in August, from $840,000 in July.

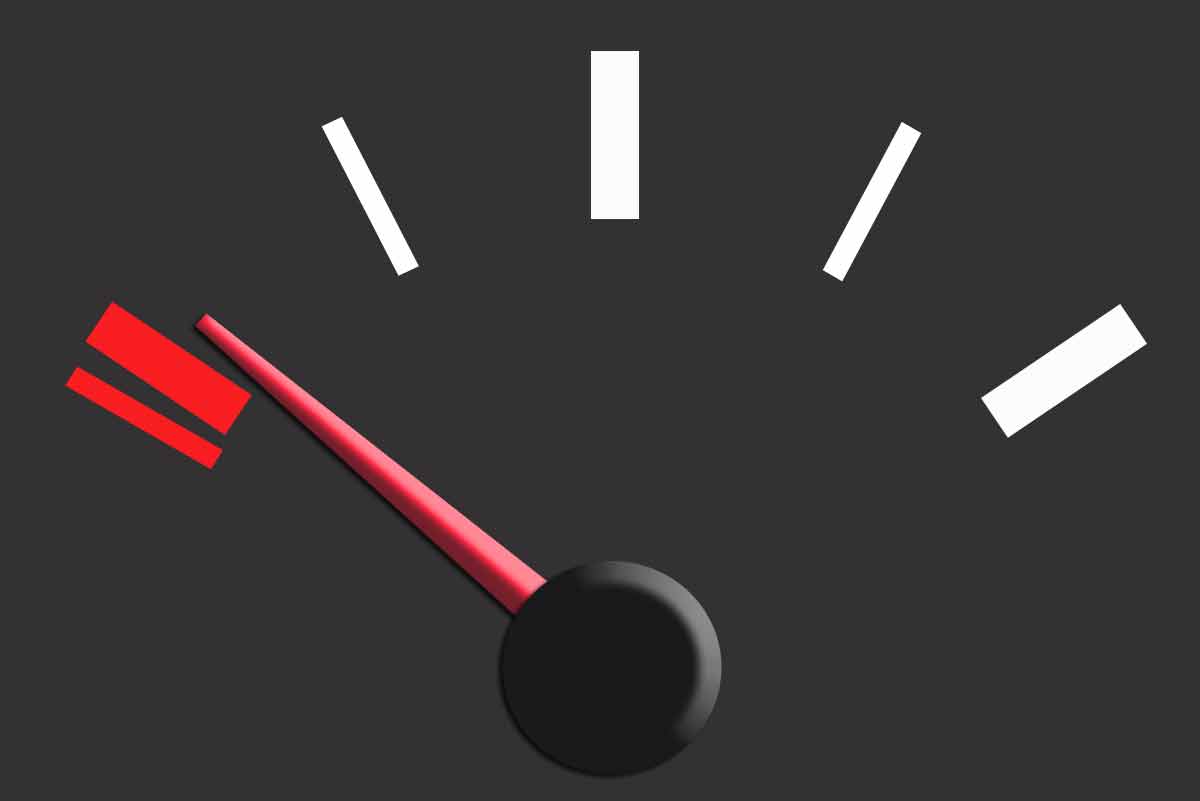

However, Barfoot & Thompson managing director Peter Thompson said house prices may have continued to rise, but signs the rate of increase is slowing, first apparent in July, were still present.

The slow-down was not so obvious when comparing August data with that for July, but when looking at the average for the previous three months it becomes more apparent, he said.

For example, while the average price was up 4.5% on that for July, it was up only 2.6% on the average price over the previous three months.

The same trend can be seen with the median price which was up just 1.2% on July and only 2.5% over the previous three months.

“Our data shows that those claiming the average price is on the verge of topping $1 million are over inflating where prices are heading,” he said.

“Current price increases are relatively modest compared with what has occurred in recent years.”

Further evidence of a slowdown could be found in Barfoot & Thompson’s data on sales numbers, listings at month end and new listings.

Thompson said sales numbers were down 9.2%, available properties were up 6% and new listings remained at the same level.

This has led to a small increase in the choice available for buyers, but also indicates some heat coming out of the market, he said.

“The continued rise in prices with lower sales indicates that new regulations requiring investors to have greater equity than previously, which the trading banks enforced at the start of August, has had a limited impact on prices but may have affected sales numbers.”

In Thompson’s view, the real test of where prices are heading will come this month with the arrival of spring.

“For the past three years, September’s average and median prices have exceeded those for August, with prices then continuing to increase to year end.”

Economists looked to the sales figures, rather than the price figures, as the interesting part of the Barfoot & Thompson data.

ASB economist Kim Mundy said total listings continue to climb as new listings outpace sales, which were flat in August after falling in July.

It appears that people could be rushing to list their homes ahead of the new LVR restrictions due to be implemented in October, she said.

“While sales activity held up in August, it was far from a strong month and may be the result of banks already acting in the spirit of the new restrictions, therefore limiting investor activity in the market.”

Inventory levels may have lifted for the past four months, but they remain near record lows and the market still has a long way to go before demand and supply are back in line, Mundy said.

With the new LVR restrictions due to come into effect in October, the next few months are set to be interesting for the Auckland market.

Mundy said ASB will be watching to see whether sales activity starts to cool.

“On the whole though, listings remain low, population growth remains strong and interest rates are near or at historical lows.

“Auckland building activity is also some time from matching population growth. All of the above factors will keep a floor under Auckland house prices.”

Search

Search