More Stories

Tuesday, December 23rd 2025

Record levels of first home buyers taking out low deposit loans

About half of all first home buyer lending has been done at a less than 20% deposit in recent months.

Thursday, December 04th 2025

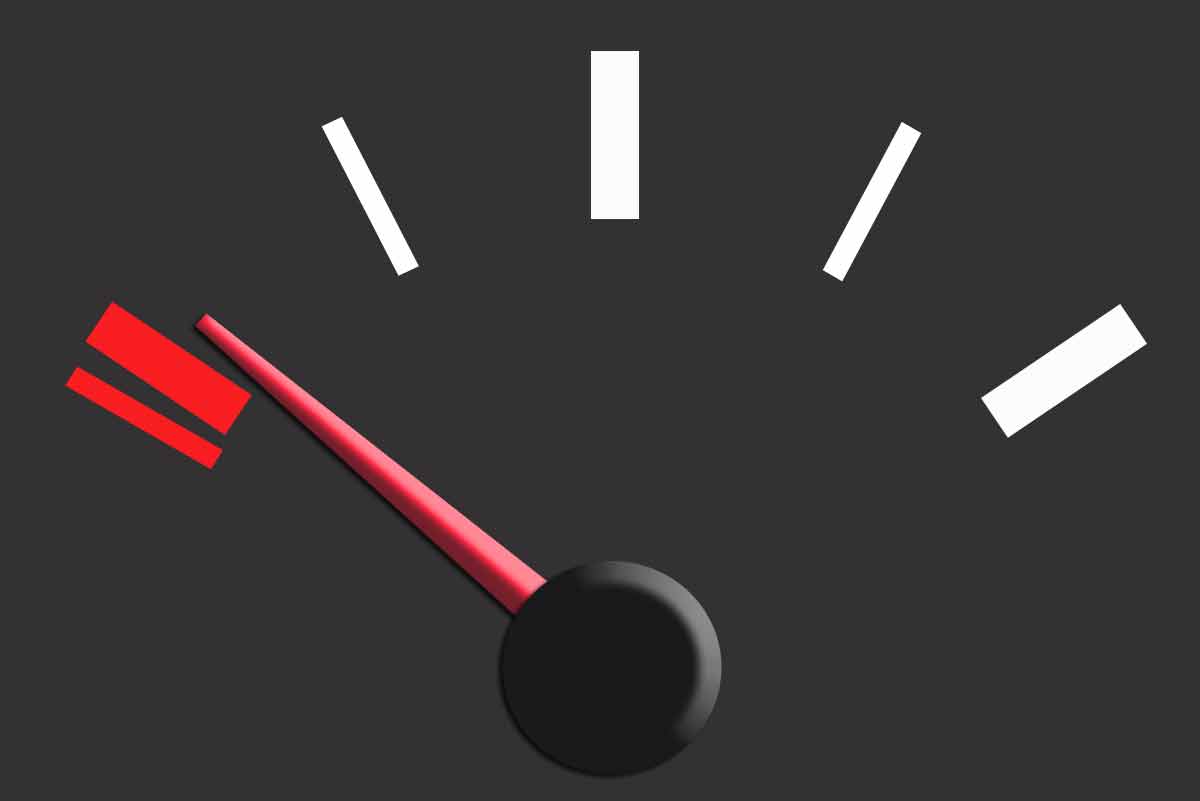

Buyers sitting on the sidelines in best time to buy in a decade

Stable house prices, low interest rates and plenty of houses to choose from are still not enticing buyers.

Tuesday, December 02nd 2025

Differing views on 50-year mortgage

US president Donald Trump recently raised the idea of 50 year mortgages; but New Zealand advisers say such long loans won’t take off in New Zealand.

Wednesday, November 26th 2025

Houses selling at a loss hit a 12 year high

About one in five Auckland residential properties (19.3%) sold for less than their original purchase price in the third quarter, up from up from 15.9% in the second quarter.

Search

Search