How does this sound when buying your professional indemnity insurance:

No-strings-attached quotes, no need to sign yourself over to a new broker just so you can get a price, complete clarity and transparency around policy wording and fees, and premiums that will be around 10%-15% lower than the low rates we negotiated last year?

(You don’t hear that often in insurance; “we are going to have lower rates again this year”, right?) But that’s one of the ongoing objectives of the Quadrant PI insurance scheme; making sure pricing fairly reflects risk and claims experience.

Quadrant PI Ltd is the brainchild of a small group of advisers who saw their annual PI premiums skyrocket in price about 3 years ago, for no apparent logical reason. Their risk profiles hadn’t changed for the worse, and there had been no adverse claims against them but their premiums had suddenly tripled. If anything their new FAP’s were arguably better run and had more safety systems and presented less risk to insurers of claims.

It didn’t make sense to these advisers who knew a thing or two about insurance. So the group decided to take control and launch their own PI scheme – and one specifically designed by NZ financial advisers, for NZ financial advisers.

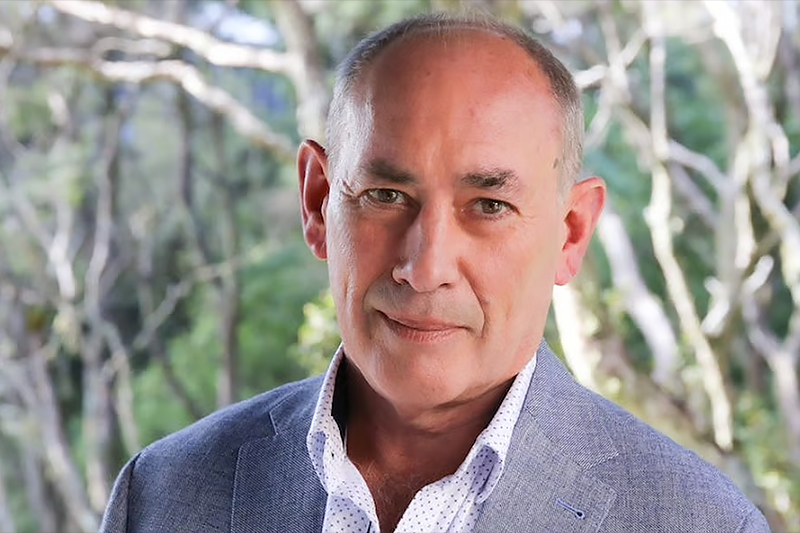

Quadrant director Tony Vidler says the ease with which advisers can access the product is one of its biggest drawcards. While some PI providers require advisers to join an industry association and agree not to shop around among competitors before giving them a quote, Quadrant welcomes all comers who meet its criteria.

“We’ve made it very easy for someone to get a quote, regardless of what their industry affiliations are, which most of the other schemes don’t allow,” Vidler says.

Advisers who want to check out Quadrant can see the policy wording before buying a policy – something almost unheard of with most PI providers preferring to leave policyholders in the dark about the wording until they had bought cover. Even then, some providers would not give provide the policy wording.

So transparency in PI insurance offerings in NZ is something Quadrant wanted to change. So too is the ability for advisers to make business decisions which are good for their business, not someone else’s business.

“I don’t want to have to pay to belong to an association or group and then also have to subscribe to another set of rules or limitations from them in how my business can be run just because I need a PI insurance policy and they seem to have a well priced scheme”, says Kevin Smee, the Chairman of the Quadrant board.

Price should not be everything, even though historically that is how advisers have “shopped” for their PI cover.

Quadrant, Smee says, has zeroed in on price reduction and being far more transparent with policy wording, brokerage and fees, but does stress “good insurance policies provide real protection, and they need to be fairly priced to reflect that. We get that and know that commercial risks are on the rise, so lowest price is not necessarily the primary objective in this space. Great value for money matters, but more importantly we feel that NZ financial advisers should enjoy the same standards their clients do in buying insurance. Financial advisers deserve value for money and fairness too.”

Quadrant does some other things very differently too, such as allowing advisers to join part way through the year, or cancel part way through a year and move on if that is their business decision. Generally adding an extra adviser or two doesn’t come at an extra cost during the year as the primary drivers for pricing are total turnover of the FAP together with the balance of business lines undertaken by the FAP. Quadrant does allow members to adjust their sums insured up or down within a policy year if there is a significant change in the FAP though too.

Another significant benefit of Quadrant’s scheme is that retroactive cover is automatically included for all members. This means a Quadrant policyholder is covered for advice he or she has given in the past, no matter which insurer held the policy at the time. “It’s a pretty big deal,” Vidler says. “Most advisers don’t understand how important this is.”

Quadrant’s directors are Kevin Smee, Royden Shotter, Jason Kilworth and Tony Vidler. All are practising advisers with decades of industry experience, and the Quadrant product is underwritten by QBE and accessible through broker Phil Mitchell of Hutchison Rodway.

Enquiries to the Broker:

Phil Mitchell

Hutchison Rodway Insurance

40 P Constellation Drive | PO Box 100 461 | Auckland 0745

Phone: 09 473 6921 DDI | Fax: 09 479 3182 | Mob: 021 8 222 99

Click here for our disclosure statement

Financial Advisers (Disclosure) Regulations FSP Licence Number 105770

Search

Search