The city’s biggest real estate agency Barfoot & Thompson sold 91 properties priced at more than $2 million – the highest in a month for 20 months. Of this number, 24 sold for more than $3 million, also the highest number for 20 months.

Barfoot & Thompson managing director Peter Thompson says the housing market has accelerated with sales numbers increasing significantly and prices recovering most of the lost ground recorded in the past 12 months.

“November was the month when all the talk about positive gains for the housing market showed up in the sales data,” he says.

“A modest but steady recovery surged in the later part of the month, indicating December will also be a good trading month.”

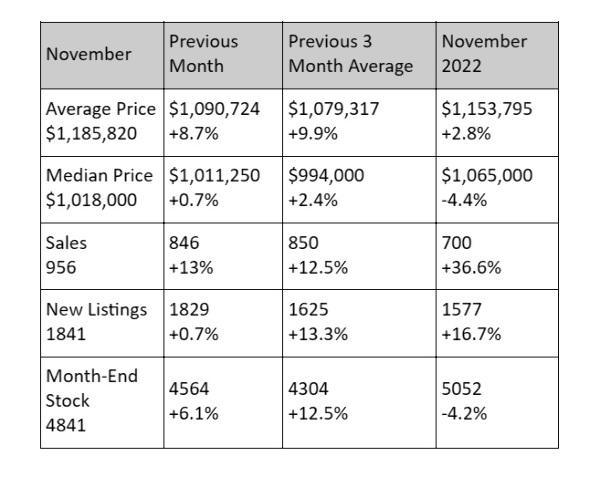

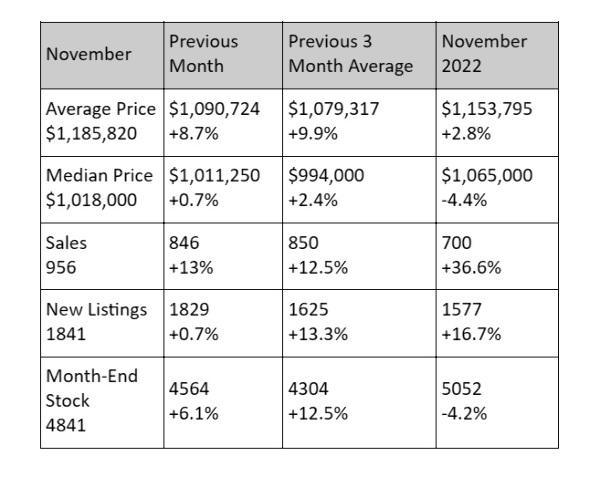

The agency sold 956 properties last month, up 13% on the previous month and a third higher than in the same month last year. It is the highest number of properties sold in a month for 21 months.

Property prices have started to bed in, with the median price hitting $1,018 million, the in eight months, while the average price at $1,185 million was the highest in 19 months.

Significantly, the average sales price for the month was up 2.8% on that for November last year. This is the first time a 2023 average monthly price has exceeded its 2022 equivalent.

The median monthly price in November is within 4.4% of its 2022 equivalent, the closest the 2023 monthly median price has come to matching that for 12 months earlier.

“This demonstrates the prices being paid are no temporary, short-term recovery, but show a sound, rising market,” Thompson says.

“New listings in the month at 1,841 were the highest for the past 20 months, and month-end properties for sale at 4,841 were 12.5% higher than they have been for the previous three months.

Search

Search