This compares to Australia where the employer contribution is guaranteed at 11%.

Meanwhile, on the employee side, the average contribution rate for the 12 months from June 2022 to 2023, was 4.3% according to the report - significantly lower than National Capital’s optimal index of 6.3%.

This doesn't bode well for the retirement prospects of New Zealanders, says the report, leaving most 65-year olds $142,000 short of the lump sum they would need for a normal weekly income in retirement.

The news was slightly more positive for National Capital’s KiwiSaver Allocation Index which measures how KiwiSaver members are invested. This rose three points to 58, representing a potential total gain of $48 billion in earnings, but again is below National Capital’s optimal index of 68.8.

National Capital assesses KiwiSaver funds’ value for money on six criteria each adding up to 100: performance after fees (25 points), value for fees (15 points), fund management capability (20 points), provider stability (10 points), portfolio composition and processes (20 points), and ethical investing (10 points). Top scorers are given an A rating.

Looking at performance, KiwiSaver funds added around $10 billion for the June quarter and gained another 25,000 members. The report data, which is after fees but before tax, shows that no funds had a negative quarter but they did not perform as well as the first three months of this year, with an average return across all funds of 2.71% compared to 4.21%.

However aggressive funds generally held their own, contributing around $438 million, with a steady return of 5.41%, similar to an average of 5.42% in the previous quarter.

In terms of value for fees, while a growing number of providers have been phasing out fixed monthly membership fees, 11 of the 24 KiwiSaver providers researched still continue to do so.

Simplicity maintained its position as the provider with the lowest fees among the growth, balanced, and conservative categories.

The average fees varied greatly across different categories. High Growth had the highest average fees at 1.12%, while Conservative had the lowest at 0.61%.

Some providers (BNZ, Booster, Fisher Funds, KiwiWealth, and Nikko) refer to buy/sell spreads, whereas Milford refers to swing pricing in their product disclosure statement.

The report says, the purpose of buy/sell spreads and swing pricing is to protect the value of existing units held by investors by apportioning the transaction costs associated with buying and selling of units to those investors doing so.

On ethical investing Booster KiwiSaver’s Socially Responsible Moderate fund topped the charts with a score of 9.83, while Booster’s Socially Responsible High Growth fund was second place. Nikko, Juno, Superlife, KiwiWealth and Pathfinder also rated highly by this measure but 37 out of the 110 funds analysed scored below the average ethical investing score of 6.

On process and portfolio the data showed KiwiSaver funds have increased their average net cash holdings from 9.26% to 11.40% funded by a reduction in equity assets, and most had a marginal increase in bond allocation. Most providers maintained their investing style between growth and larger value companies, while a consistent increment of current yield was observed across all portfolios.

Massively missing out

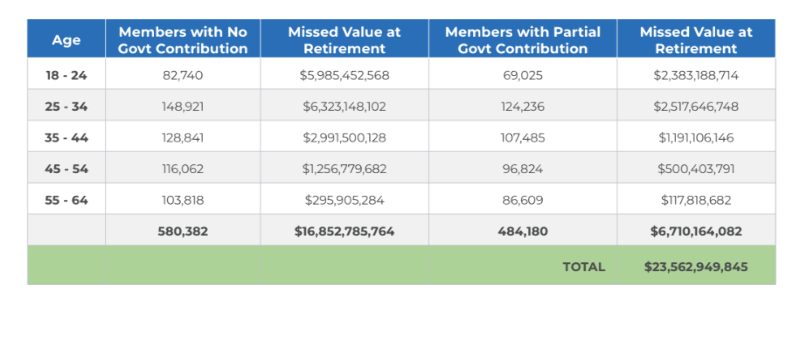

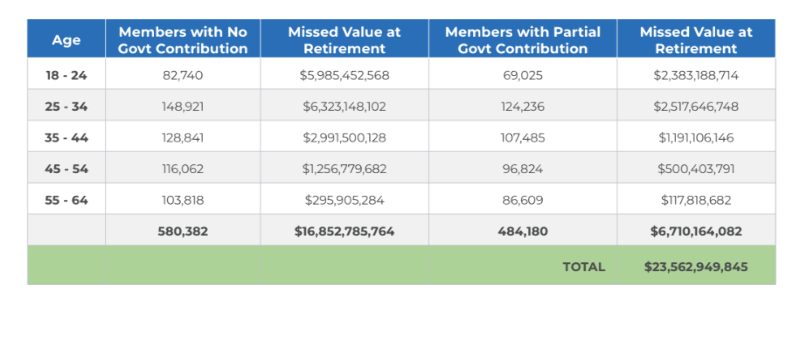

In a break out analysis the report tackles the problem of non-contributing KiwiSaver members missing out on the $521 Government contribution. Research from Massey University has revealed that between July 2021 and June 2022, more than one million members collectively failed to qualify for $423 million in Government payouts because their individual contributions for the year were less than $1042.

Breaking it down 580,000 non-contributing members missed out on a collective $302 million, and 484,000 partial-contributing members missed out on a further $121 million.

Applying National Capital’s optimal allocation of 6.3%, this means these cohorts would potentially miss out on $23.5 billion over their working lifetime.

The report says the Government needs to improve its efforts on educating Kiwis on the importance of making minimum contributions.

Search

Search