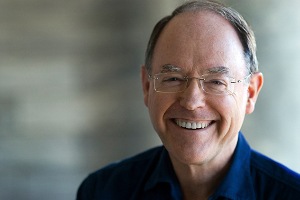

At the FSC: Get in Shape conference. The FMA director of market engagement, John Botica became a momentary mythbuster when sharing new data which contradicted long-standing myths of the adviser industry.

Botica began his address by sharing FMA stats that bode well for an industry on the cusp of major regulation change. Speaking on Tuesday Botica said that “As of today there are over 2200 businesses that are license ready. There are more than 9600 advisers working for those businesses.”

But it was when Botica turned his attention to mythbusting that the data got interesting.

“There are two or three industry myths that I want to bust. The first one is around the myth of the aging adviser. You might be surprised with the statistics. 60 percent of today’s advisers are aged under 50. 30 percent are between 51 and 65. 7 percent are over 65. Interestingly 3500 advisers are aged under 40.”

“You see from those numbers that there is not a large number of those advisers that we nicely refer to as grey panthers. Clearly we still need to focus on bringing more young people into the industry, but these statistics look quite different than a lot of myths that we talk about.”

The next myth that Botica turned to was the “death of the solo adviser through licensing”.

“This myth is something that I have never really believed nor supported, and the licensing statistics back that position. More than 50 percent of the firms that we have granted transitional license to so far are solo businesses.”

“That fear that there would be consolidation across the market, particularly that some of the larger firms would look to buy up the smaller firms, isn’t happening. In fact the solo adviser firms are actually dominating the market.”

The other myth that Botica wanted to bust was the terminology around “holistic advice”.

“It’s a term that personally I hate. It gets bandied out every time there is a crisis and covid is no different. What I come back to is, isn’t giving advice about relationships? Don’t good advisers actually partner with their clients? Advice does all of these things already so why don’t we just call it what it is instead of using these terrible terms?”

Botica finished off his myth busting with a challenge to the audience of assembled advisers. “My challenge to you is to be brave with advice. Challenge your clients, offer alternatives, and use scenarios that are effective.

“Don’t just make the changes to your businesses because of the regulatory requirements. All the changes have been designed to improve the quality of advice. They have not been designed as hurdles to stop you delivering what you do best.”

![[TMM Podcast] Yelsa serves up “marine reserve” of property buyers](https://www.goodreturns.co.nz/pics/mike%20harvey.jpg)

Search

Search