Ongoing talk on ways to cool the blistering housing market isn’t resonating with Kiwis according to the latest ASB Housing Confidence Survey, with expectations for New Zealand house prices now sitting at a record high.

ASB senior economist Mike Jones says, “after a brief dip during lockdown, price expectations have spiked. In October a net 67% of people expected house prices to keep rising over the coming year – the highest month in the 24-year history of the survey.”

Jones says: “Rightly or wrongly, these results suggest housing is increasingly being perceived as a ‘one-way bet’."

He says the Reserve Bank's move to bring back LVR restrictions back and the roll-back of some other policy supports, "promise to take a little heat out of what may otherwise have been a summer scorcher,” Jones says.

For the three months to October, net 45% of respondents say they expect house prices to continue rising - a marked increase from the net 9% expecting a fall in the second quarter of the year.

Jones says the shift is another indicator that New Zealand’s Covid-19 economic recovery is progressing better than initially expected.

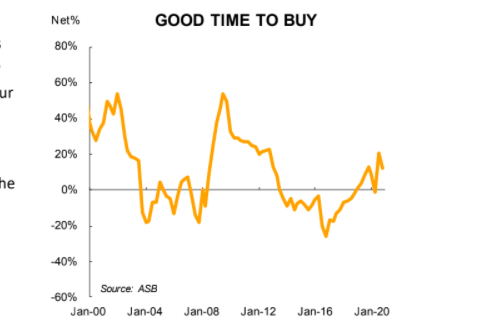

The market pendulum has swung again in the latest quarter, with a net 12% of people seeing now as a good time to buy, down from net 21% in the previous quarter.

Jones says, “this fall might seem at odds with the various supports in play, including mortgage rates at record lows, the earlier removal of LVR restrictions and extension of the mortgage holiday scheme.”

But he says affordability appears to be the main driver of the shift in buyer perceptions.

“We tend to observe a pretty strong inverse relationship between the level of house price inflation and perceptions of whether it’s a good time to buy, and this has shown up in our survey via a steep drop in buyer sentiment. Certainly, affordability is under pressure.”

“If our forecasts prove correct, the pendulum looks set to swing even more in favour of sellers over coming quarters. Mortgage rates are expected to fall further and we expect the housing boom to keep chugging through to at least mid-2021.”

“Affordability metrics are already close to record highs and look set to worsen further. It is now clearly a sellers’ market,” Jones says.

Jones says people are expecting interest rates to fall further. “We think one and two-year fixed mortgage rates will ultimately move closer to 2% than their current roughly 2.5% levels. That’s even without the RBNZ having to resort to negative interest rates, which we no longer see as likely.

See the lowest two-year fixed rates here.

“In other words, we see further support for house prices, and housing confidence, ahead,” Jones says.

Search

Search