Westpac announced Friday that interest-free loans of up to $10,000 to improve energy efficiency will now be available to its home loan customers.

The loans, which are called Westpac Warm Up, are intended to help fund the purchase of heat pumps, solar panels, ventilation, double glazing or insulation.

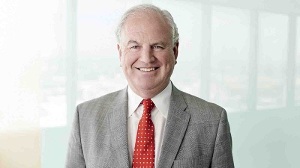

Westpac chief executive David McLean says big businesses have a duty to take action on important social, economic and environmental issues like climate change.

“We think climate change is the biggest environmental issue we face and is a very real threat to our economy and wellbeing. New Zealand needs to accelerate its response to climate change.”

As such, they have an important role in the transition to a cleaner economy through their lending, he says.

“That’s why we’re committed to offering products and services that can cut our customers’ costs and their carbon footprint.

“Our new Westpac Warm Up loan offering is one way we can help New Zealanders make their home more energy-efficient, while also improving the quality of our housing stock for future generations.”

The new loan product was announced as part of a broad package of initiatives on the part of the bank, which has just become New Zealand’s first carbon zero certified bank.

These include transitioning 100% of their car fleet to electric vehicles by 2025 and committing to a further 30% reduction in their emissions, on top of their 50% reduction since 2008.

But Westpac will be competing against one of its major rival’s, ANZ, in the clean, green, environmentally friendly space.

Through its Healthy Homes loan product, ANZ offers interest-free home loan top ups of up to $5,000 (for four years) for insulation and heat pumps. It also has a scheme where it offers up to 1% off home loans for new build properties that meet sustainability and energy efficiency requirements.

Read more:

ANZ goes green with healthy home discount

Search

Search