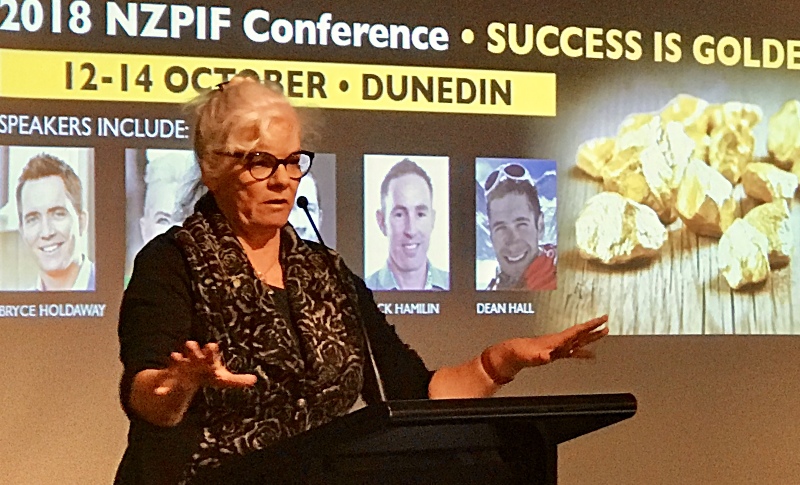

At the recent NZ Property Investors Federation conference, Tenancy Tribunal chief adjudicator Melissa Poole shared some insider information.

It may be responsible for some controversial decisions hated by landlords – such as the infamous Foxton dog urine damage ruling – but landlords need the Tenancy Tribunal.

The bulk of the cases heard by the Tribunal are taken by landlords, with around 70% of them involving rent arrears issues.

Despite this, a lot of confusion and uncertainty surrounds the Tribunal and its workings.

A basic explanation is that the Tribunal holds hearings to settle disputes between tenants and landlords.

It can formalise what has been agreed on in mediation, make a ruling on an issue that can’t be resolved and issue legally binding orders on the parties involved in the dispute.

The Tribunal is a civil jurisdiction and operates under the auspices of the Residential Tenancies Act (RTA), which sets out its functions, powers and the extent of its authority.

Going by volume, it is New Zealand’s biggest and busiest Tribunal with over 20,000 hearings a year.

But that summary does little to explain how the Tribunal works. To get clarification for landlords we looked to Tenancy Tribunal chief adjudicator Melissa Poole.

At the recent NZ Property Investors’ Federation conference, Poole gave a comprehensive presentation on the Tribunal and what landlords need to know.

In the December issue of NZ Property Investor magazine, we feature the edited highlights of her presentation.

But Poole’s first point is that it is important to remember that the Tribunal is bound by the decisions of higher courts.

The Tribunal sits at the bottom of the judicial heap. Sitting at the top is the Supreme Court, followed in descending order by the Court of Appeal, the High Court, and the District Court.

Poole says that means landlords need to understand that some of the decisions Tribunal adjudicators make are influenced by decisions from the higher courts.

“We have no power over them and we are bound by their decisions.”

To read more about Poole’s take on the Tribunal click here to get the digital issue of NZ Property Investor magazine.

Subscribe to NZ Property Investor magazine here to get great stories like this delivered to your mailbox every month.

Search

Search