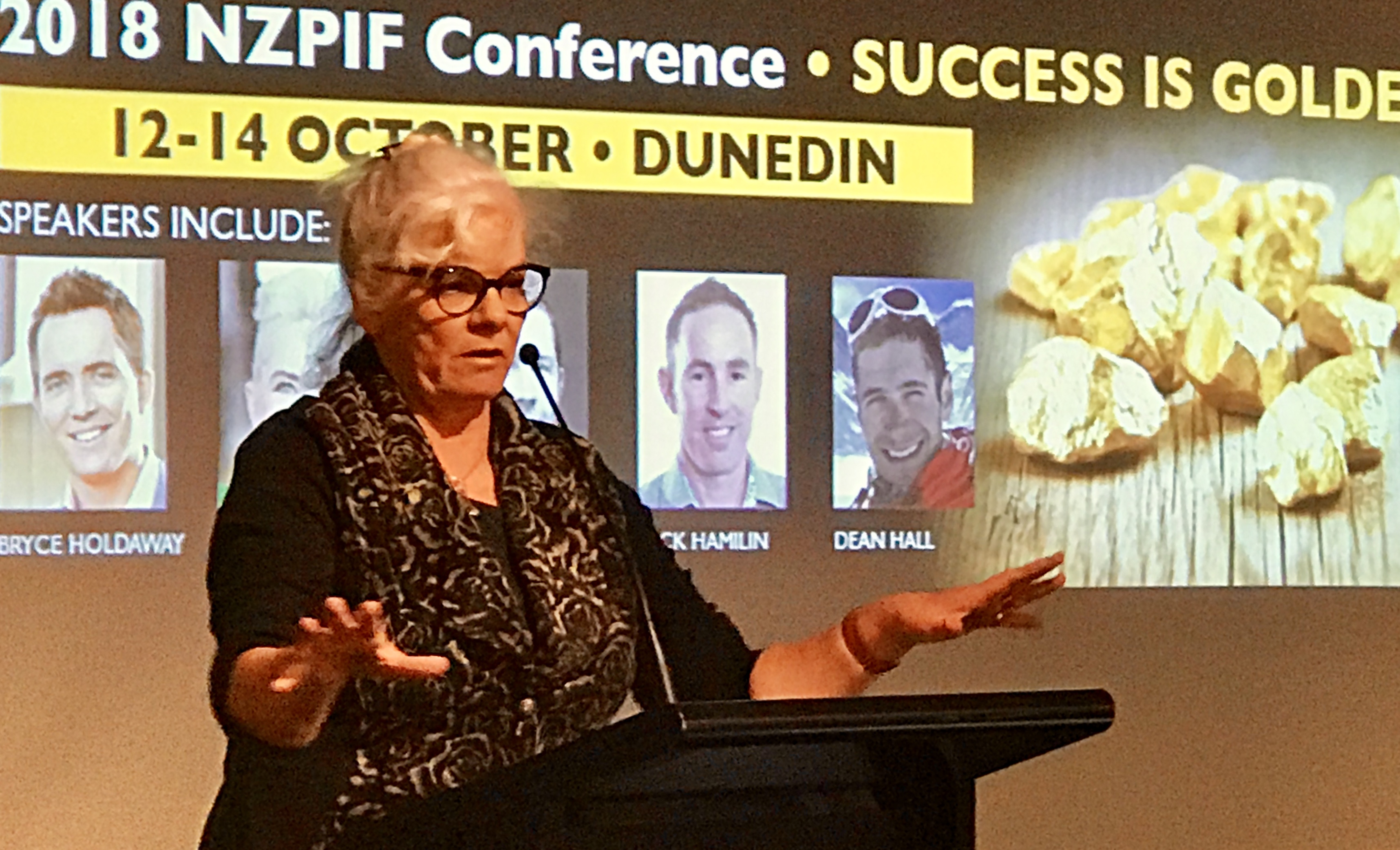

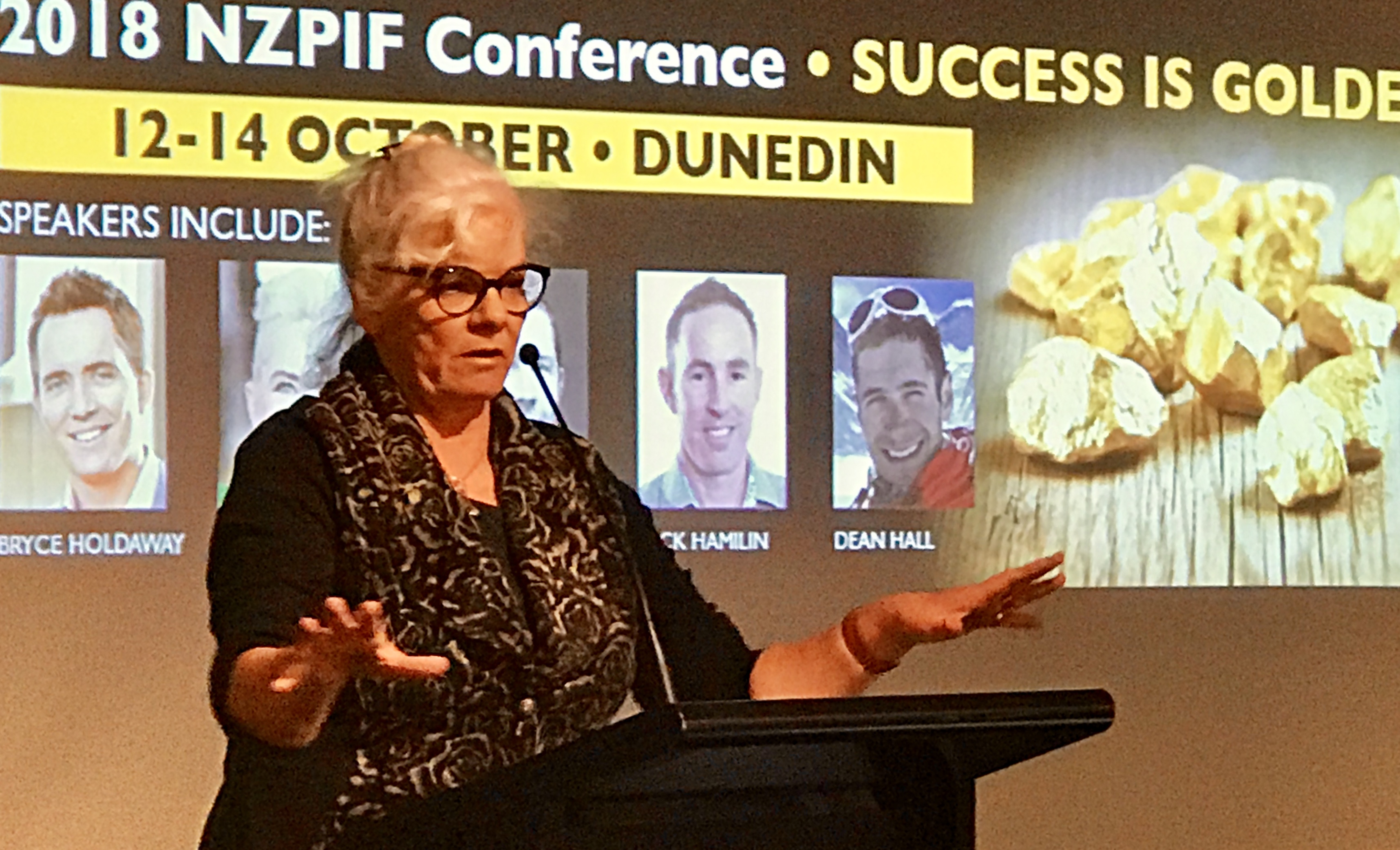

Tenancy Tribunal chief adjudicator Melissa Poole

Tenancy Tribunal chief adjudicator Melissa Poole said it will use the 15mg level as proposed in the Gluckman report - as long as the meth test was done after the report was released on May 28 this year.

She told delegates at the NZ Property Investors Federation conference in Dunedin that the Tribunal had done a lot of work and talked to many people about the standard, including Housing Minister Phil Twyford.

The Tribunal’s hand was somewhat forced by Housing New Zealand’s decision to use 15 as its standard just days after the Gluckman report was released.

“One of the difficulties for us is if you have the biggest player in town going with 15 as the standard it becomes very difficult for us to say to you guys you’re not Housing New Zealand so we are going to apply NZS (1.5 ) to you.”

She said if the Tribunal was using 1.5 it would “effectively penalise private landlords.”

“We have taken a pre-emptive step and say ok from the date the Gluckman report was released we will accept 15 as the standard.”

She said there were some important differences between the NZS standard of 1.5 micrograms per 100cm2and the 15 proposed by Gluckman.

The NZ Standard was set at a level where it was confident of no risk,” while the Gluckman report, which reviewed all published scientific evidence, set the 15 level as being the “point at which it was reasonably confident there was no risk or harm.

“It’s gone from watertight to risk evaluations.”

Poole said the Tribunal could use the 1.5 level if an applicant presented evidence that there were “other factors” such as meth manufacturing in a rental.

“if you think there’s a risk of more than smoking you have to bring evidence. Then we can look at 1.5. it’s all about the evidence landlords bring to us,” she said.

Poole said the Tribunal does not set the law; “It doesn’t set the standards. It applies the standards.”

“Once the Gluckman report came out we couldn’t ignore it,” she said.

Search

Search