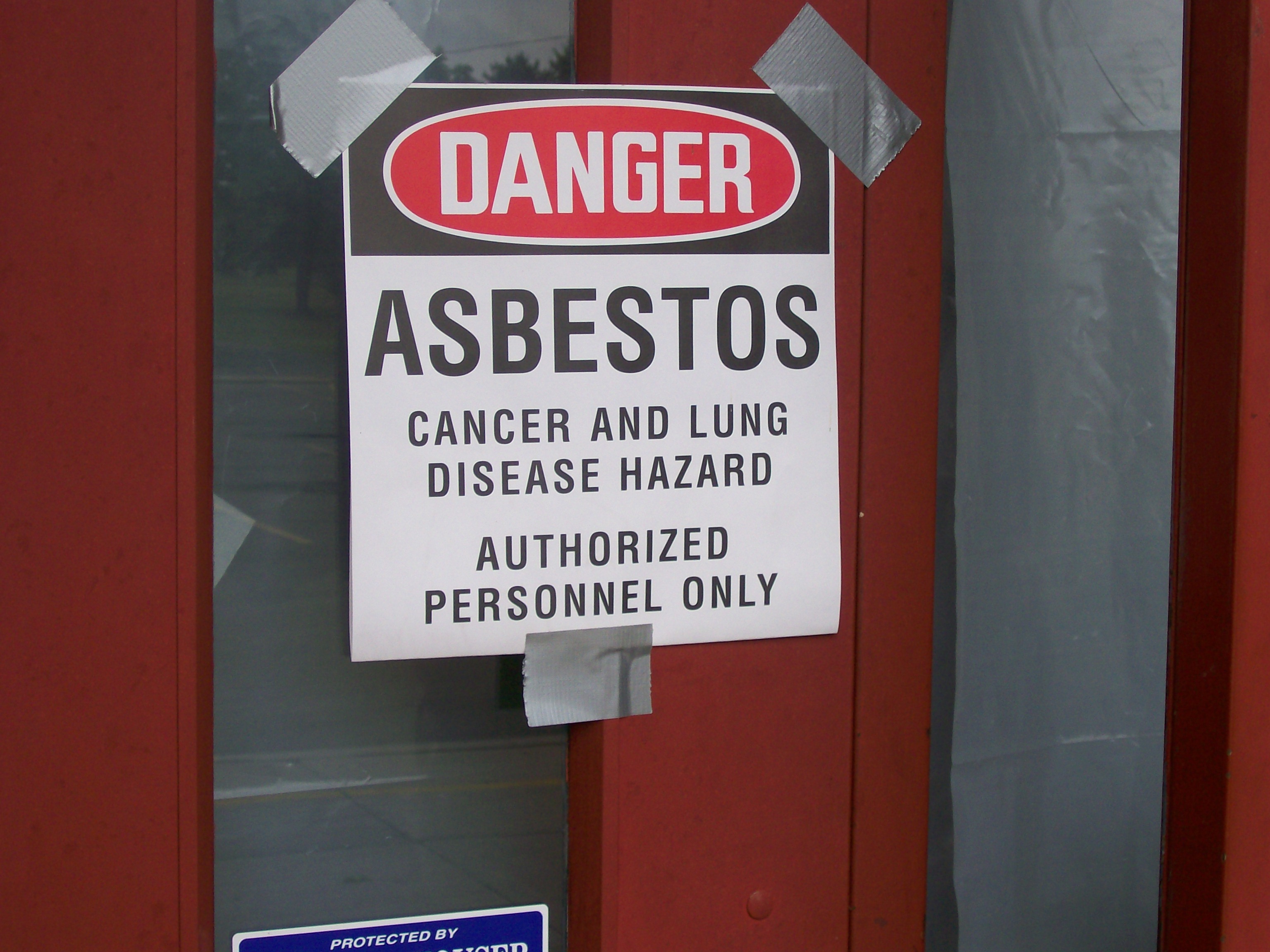

The Health and Safety at Work (Asbestos) Regulations 2016 came into effect in April and they mean there are new rules for residential landlords when it comes to asbestos.

Under the new rules, property owners with a property which is operating as a workplace must not only identify whether asbestos is present, but have an asbestos management plan in place.

However, there has been some confusion over what exactly this means for residential landlords.

In response, WorkSafe has now released a policy clarification which details when residential landlords are required to identify asbestos and prepare an asbestos management plan.

It says that landlords must identify asbestos and document plans for managing its risks in an asbestos management plan, if there is a risk of exposure to respirable asbestos fibres from work being carried out on the property.

Exposure is likely to occur from dust created when drilling or cutting into asbestos-containing materials so the types of work that create risk may include renovations, refurbishments or demolition work.

But WorkSafe has clarified that the duty only applies when a landlord is planning and carrying out work to their property and to the area relevant to the work creating a risk of exposure.

Landlords also have to ensure they co-ordinate and co-operate on these duties with other people involved in any such work, such as property managers and building contractors.

REINZ chief executive Bindi Norwell says clarity was needed because the wording of the legislation suggested that every residential rental property built before the year 2000 would require a comprehensive asbestos management plan.

“If this was the case, it would be a prohibitive cost for most landlords.”

But WorkSafe’s clarification means that asbestos management plans are not automatically required for all rental properties – instead they’ll only be required if work on a property which creates a risk is planned, she says.

“As asbestos management plans can cost thousands of dollars, today’s news will be a welcome relief to landlords and property managers.

“No doubt tenants will be relieved too, as this could have seen landlords seeking to offset some of the cost through rental increases.”

*WorkSafe’s asbestos guidance for landlords and property managers can be read here.

Read more:

Time to tackle asbestos

Safe as houses

Search

Search