Statistics New Zealand’s latest data shows that May saw annual net migration reach 72,000, which is yet another record high.

The annual net inflow has remained above 70,000 since October last year.

Once seasonally adjusted, there was a monthly net gain of 5,900 migrants in May, which is up on April’s gain of 5,800.

However, the monthly net gain remains well down on January’s record of 6,500.

Population statistics manager Peter Dolan said the continued high level of net migration in the May 2017 year was driven by non-New Zealand citizens migrating to New Zealand.

“Of the 130,400 migrant arrivals, three out of four were non-New Zealand citizens.”

He said that on a net basis, New Zealand citizens leaving and returning to this country almost balanced each other out in the last 12 months.

But Westpac senior economist Satish Ranchhod said May’s rise in net migration was mainly due to reduced departures of New Zealand citizens, following an unexpected pick-up last month.

“The net outflow of New Zealand citizens is at its lowest level since 1984. This accounts for half of the pick-up in net migration since 2011.”

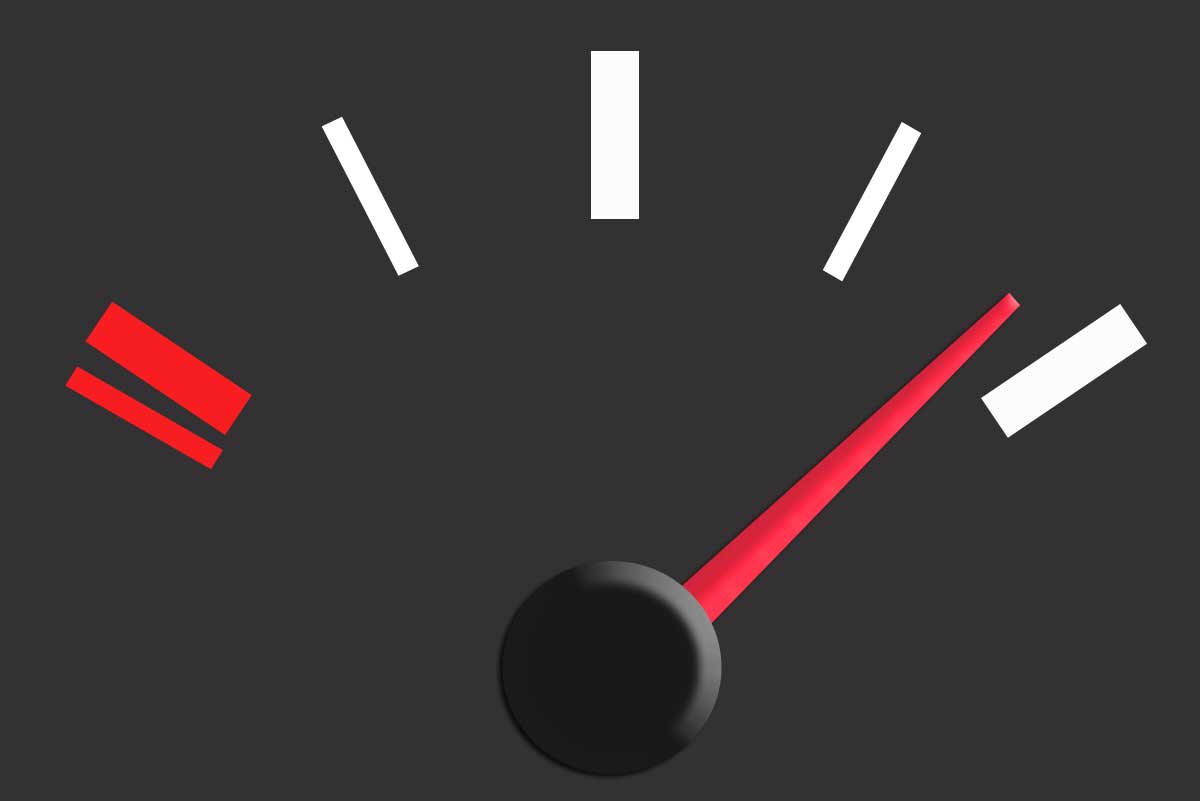

Net migration is likely to remain firm for some time yet, although it should gradually ease off over the coming years as the global economy improves and more New Zealanders start to move offshore, he said.

“Nevertheless, the eventual easing in migration looks like it will be quite gradual.

“New Zealand’s economic conditions remain relatively positive. In addition, policy changes in Australia mean that the main destination for New Zealanders travelling abroad now looks less welcoming.”

Ranchhod added that the key risk for the migration outlook is a policy change following September’s election.

Infometrics economist Mieke Welvaert said that the ongoing strong population growth is likely to have an impact on the housing market.

“It is hard to fathom that more and more people will just keep squeezing into the same number of houses and so we do project that house sales will pick up again.”

Read more:

Challenges ahead for Govt build project

Primed for future growth

![[OPINION] Recessionary times](https://www.goodreturns.co.nz/pics/people/thumbs/300/Gilligan_Matthew_GRA%20New.jpg)

Search

Search