In recent months QV’s monthly house price index has indicated that property values in Auckland were levelling out.

Now QV’s data shows that the average value in the Super City region dropped to $1,043,680 in February – down from $1,047,699 in January.

Once adjusted for inflation, values still rose 11.3% year-on-year, which left it 61.0% above the 2007 market peak.

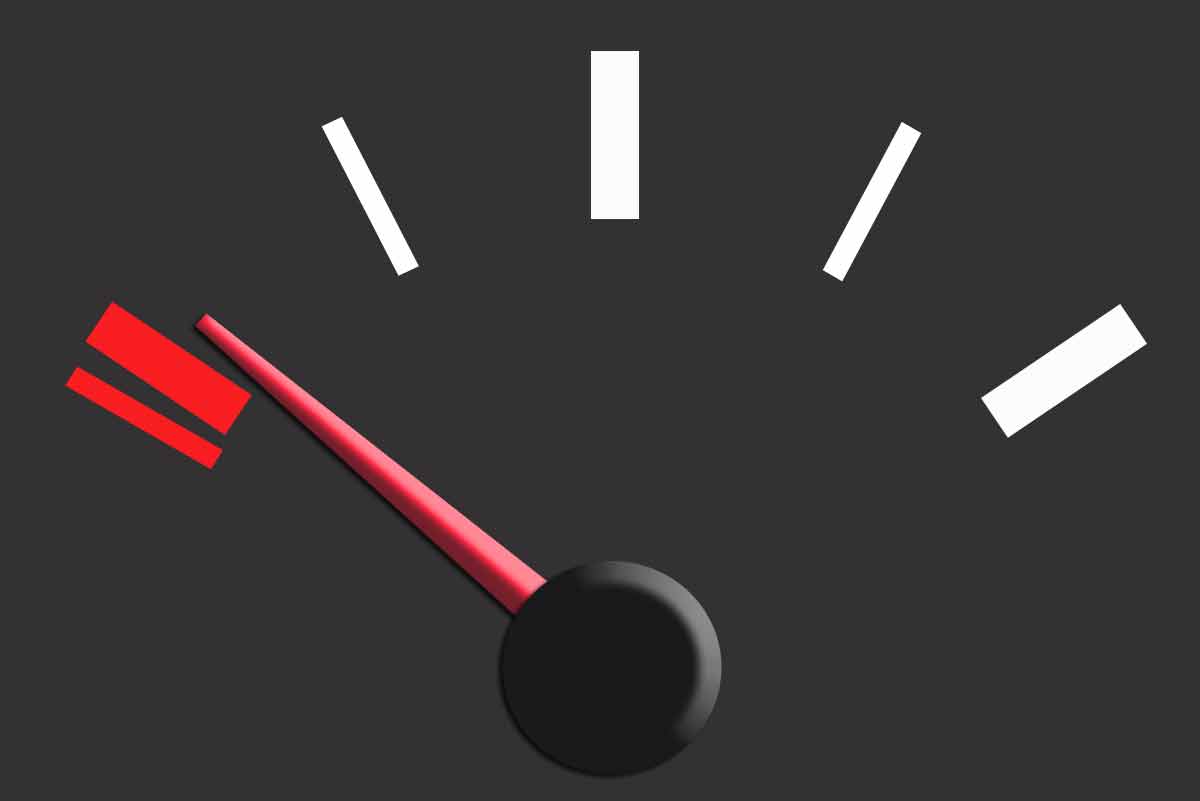

But Auckland’s quarterly value growth decreased by 0.7% in February, after slowing to just 0.2% growth in January.

QV national spokesperson Andrea Rush said that while parts of Auckland have seen values drop, values continue to rise in central Auckland, Waiheke Island and in Rodney and Franklin.

The same trend of negative growth was seen in parts of the Auckland market this time last year following the introduction of the October 2015 30% LVR rules for investors, she said.

“And then values began increasing again by April 2016.

“So it’s possible this latest quarterly decrease will be relatively short-lived as the market drivers of relatively low interest rates, strong net migration and a high number of sales to investors remain.”

For QV’s Auckland manager James Steele, uncertainty continues to be a feature of the Super City's market.

There has also been a surge in listings coming onto the market during February which is giving buyers more choice, he said.

“Properties at the lower end of the market in suburbs popular with investors tend to be not selling for the same premiums they were before the new LVRs came in.

“However, there are some record sales prices still being achieved and there remains strong competition for homes in areas popular with both first home buyers, movers and investors not affected by the new LVRs.”

Some investors, who have been taking a wait and see approach due to the new LVRs, have reportedly started looking again to see areas where they may get a bargain, Steele added.

It was not just Auckland that saw a decrease in property values – so too did Hamilton and Christchurch while value growth in Tauranga slowed.

Hamilton values were down by 0.8% over the past three months, which left the region’s average value at $532,171.

Christchurch values decreased slightly by 0.5% in the last quarter, leaving the average value at $498,710.

In Tauranga values continued to rise but at a slower pace than they were prior to the introduction of the LVRs.

They were up 1.3% over the past three months, which left the average value in the city at $673,923.

However, despite the value decrease in certain markets, nationwide property values rose.

Nationwide, values were up by 1.1% over the last quarter and, once adjusted for inflation, by 12.0% year-on-year.

This has left the average national value at $631,349.

Further, Rush said that values in the Wellington region continued to accelerate – with values up more than 21.0% over the past year and 4.3% over the past quarter to hit $589,784.

“The Dunedin market also remains buoyant, with strong levels of activity and demand and continued steady value growth.”

Search

Search