CoreLogic data shows that first home buyers have made up more than 21% of the Auckland market this year, up slightly on 2015. New builds require less deposit and are emerging as an option with first home buyers, up more than 2% this year on 2015, with Flatbush, Takanini and Silverdale popular locations. Meanwhile, the appetite for apartments has flatlined with fewer than 12% choosing that option.

CoreLogic Senior Researcher, Nick Goodall, said first home buyers (FHBs) had remained a solid presence in the market despite the introduction of new LVRs and a reduction in the number of listings available in recent months.

“First home buyers remained active throughout the year. Investors were quieter in the beginning of the year as they assessed the 2015 round of LVR limits requiring a 70% deposit, but by April were back to record levels” Mr Goodall said.

“Since the latest round of LVR limits introduced by the RBNZ investors have maintained their share, while the segment that has fallen away are those owner occupiers looking to move to their next home.”

Westpac’s Chief Product Officer, Shane Howell, said FHB’s seem to have the mindset that while Auckland house prices are challenging, historic low interest rates and a belief houses will not dip significantly in value was giving them the confidence to buy.

“It’s certainly not easy for first home buyers in Auckland but they know interest rates have been historically low and have set about getting themselves on the ladder,” he said. “We’re seeing deposits coming from the traditional ways of saving and family support.”

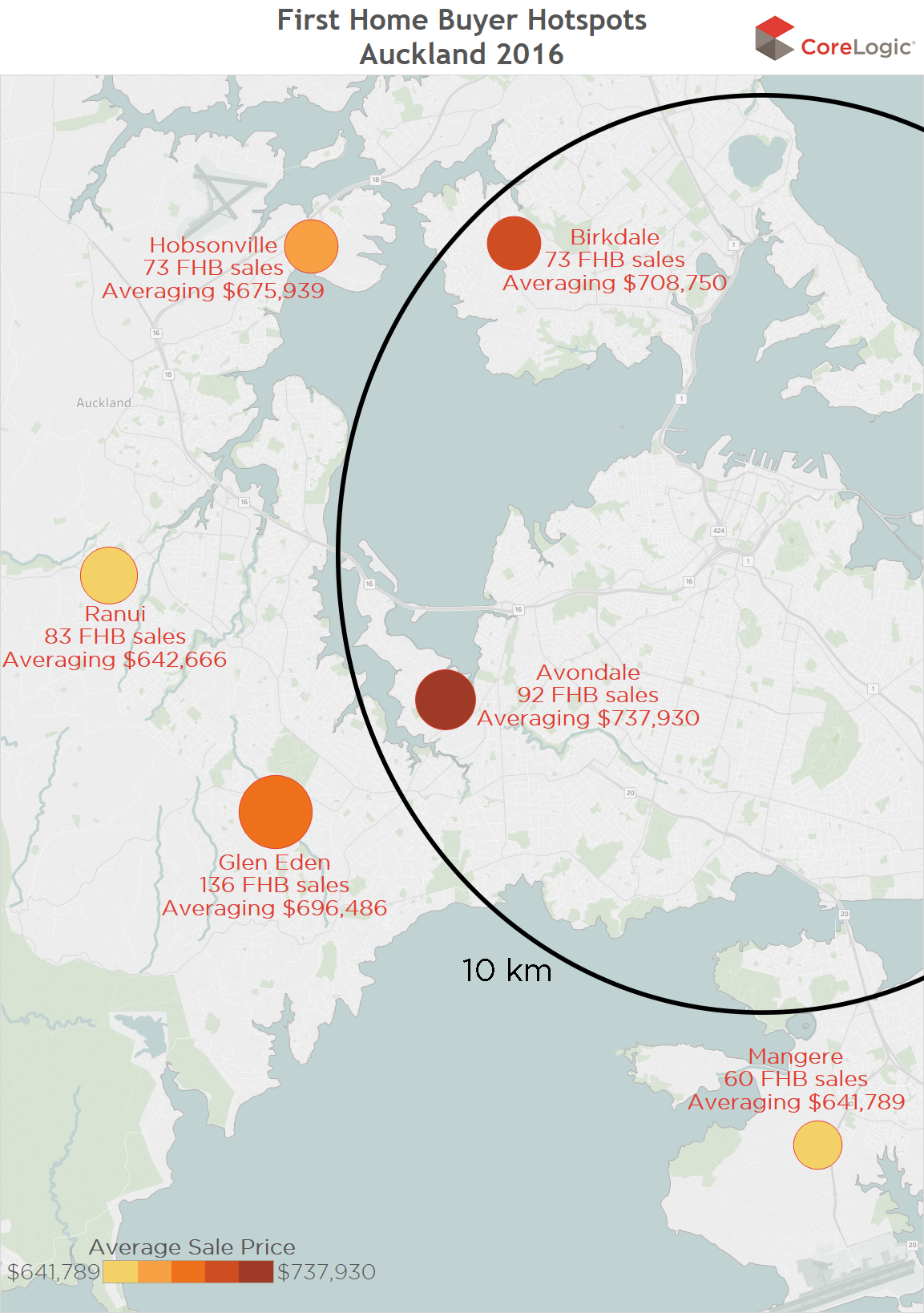

Mangere is the most popular suburb in 2016 with first home buyers with 39% of all sales going to first home buyers at an average price of $641,000, up 13% on 2015. The 60 sold were mostly standalone 3 bedroom houses built in the 1960s and 70s selling between $392,000 - $847,000. One, sold for $1.025 million.

Birkdale, on the North Shore, follows with 73 sales to first home buyers (FHB) making up 38% of all houses sold in the area at an average price of $708,000. The percentage of FHB’s was up 6% on 2015.

The next four suburbs are all based in West Auckland – Glen Eden, Ranui, Hobsonville and Avondale.

In Glen Eden 136 houses, 37% of the market, have been purchased by FHB’s from between $395,000 - $1.05m. Most of the houses were 3 bedroom standalone built between the 1950s – 1980s sold at any average price of $696,000.

FHB’s also made up 37% of buyers in Ranui, up 8% on 2015, selling for an average price of $643,000.

Hobsonville has seen a 15% spike in FHB’s on last year with homes selling between $400,000 - $949,000 with most being new properties and only two bedrooms. There were 92 houses sold to FHB’s in Avondale, up 6% on 2015, at average of just under $738,000.

The leading suburbs for first home buyers based on their percentage of overall sales as collated by CoreLogic are:

Mangere (Manukau) 60 sales in 2016 (39%), 75 in 2015 (26%). Median Value of the entire suburb’s stock $668k.

Average Sale Price for first home buyers in 2016 $641k, ranging from $392k to $847k (plus one at $1.025m)

Mostly standalone houses, 3 & 4 bedroom most popular, also 4 bedroom

1960s and 1970s houses, also 2000s.

Birkdale (North Shore) 73 sales in 2016 (38%), 80 in 2015 (32%). Median Value of the entire suburb’s stock $793k.

Average Sale Price $708k, ranging from $450k to $900k (plus one at $1.03m)

Two thirds standalone houses, mostly 3 or more bedrooms

Mix of age. Mostly pre-2000s

Glen Eden (Waitakere) 136 in 2016 (37%), 202 in 2015 (36%). Median Value of the entire suburb’s stock $735k.

Average Sale Price $696k, ranging from $395k to $1.05m Majority standalone houses, 3 bedrooms.

Age ranging from 1950s – 1980s

Ranui (Waitakere) 83 sales in 2016 (37%), 106 in 2015 (29%). Median Value of the entire suburb’s stock $697k.

Average Sale Price $643k, ranging from $320k to $939k

Majority standalone houses, 3 bedrooms

1970s and 1980s most popular, with a slight representation of post-2000s

Hobsonville (Waitakere) 73 sales in 2016 (35%), 63 in 2015 (20%). Median Value of the entire suburb’s stock $925k.

Average Sale Price $676k, ranging from $400k to $949k

New properties, mostly 2 bedrooms

Avondale (Waitakere fringe) 92 sales in 2016 (34%), 119 in 2015 (28%). Median value of the entire suburb’s stock $832k.

· Average sale price $737,930

· Majority standalone, 3 bedrooms

· Mix of pre-1970s and some post 2000s

![[OPINION] Recessionary times](https://www.goodreturns.co.nz/pics/people/thumbs/300/Gilligan_Matthew_GRA%20New.jpg)

Search

Search