The Index, which was released last week, shows the country’s commercial property sector remains buoyant.

In the September quarter, total returns for the retail and office property sectors were up by 1.8 percentage points and 0.6 percentage points respectively year-on-year.

Overall, the market delivered an annualised total return of 12.7% in the year ending September 2016.

This result is well above the ten-year average return of 10.7%.

Further, New Zealand commercial property continues to perform well in the international stakes - with the UK at 4.2%, Japan at 8.8% and the US at 10.1%.

MSCI executive director Anthony De Francesco said the market’s investment return performance remains relatively strong.

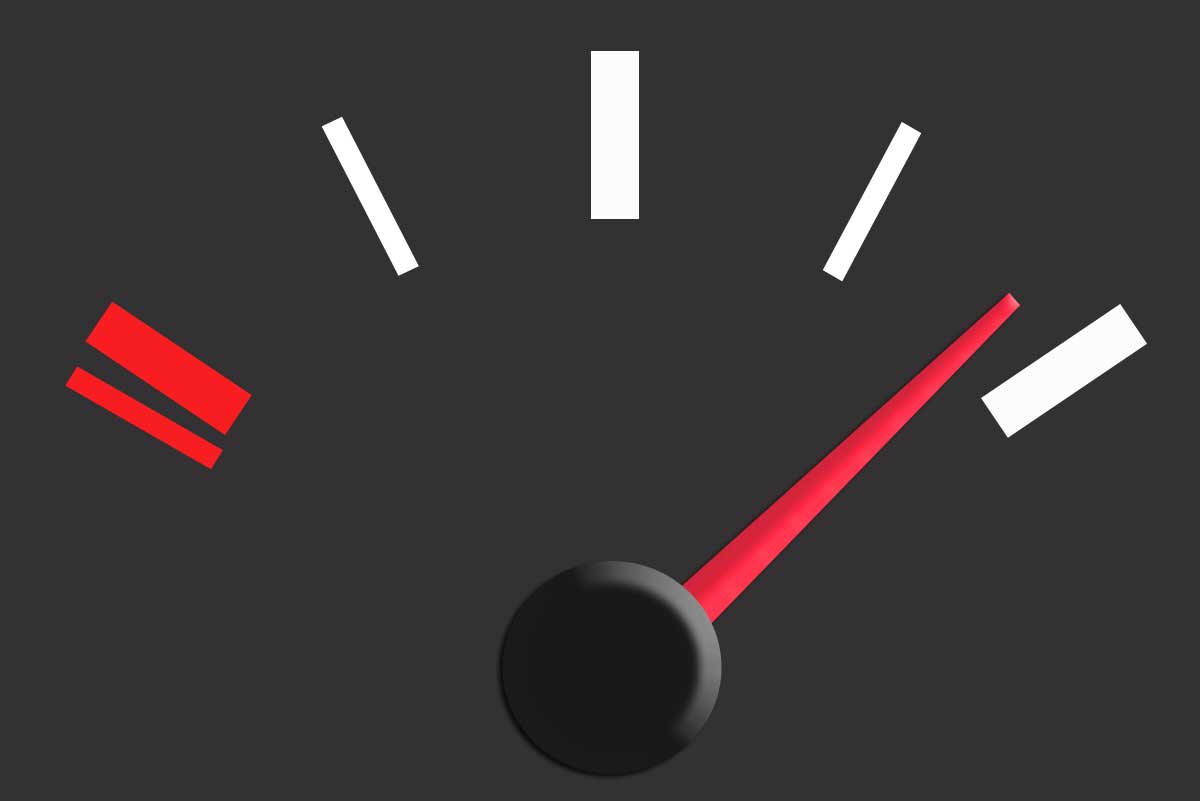

However, the market appears to be stabilising with the September quarter results showing a slight softening to the June quarter, he said.

“We are also seeing cap rates continue to firm across key sectors. Indeed, cap rates are now hovering below rates recorded in 2007.”

“Cap rates” are the ratio of net operating income to property asset value and are a key factor in the calculation of commercial property value.

The lower the cap rate, the more it will be necessary to pay for the property.

De Francesco said that a similar scenario on market pricing is evident in the Australian commercial property market.

“The scenario is mainly driven by strong capital flows into New Zealand’s investment market and the strong demand from Asia for New Zealand property assets due to their attractive high income return.”

The results are good news for both the commercial property sector and for commercial property investors, Property Council’s chief executive Connal Townsend said.

“The market did appear to moderate post Brexit but, in light of recent global economic events, New Zealand commercial property remains the silver lining in a sometimes uncertain global property market.”

However, both central and local government should take a proactive approach to ensure the commercial property sector remains resilient to a downturn, he added.

“There is a need to reduce exorbitant regulatory charges and remove cross-subsidisation.

“We must ensure the commercial property sector is not slapped with further regulatory costs. A good start would be allowing commercial properties to be depreciated.”

Search

Search