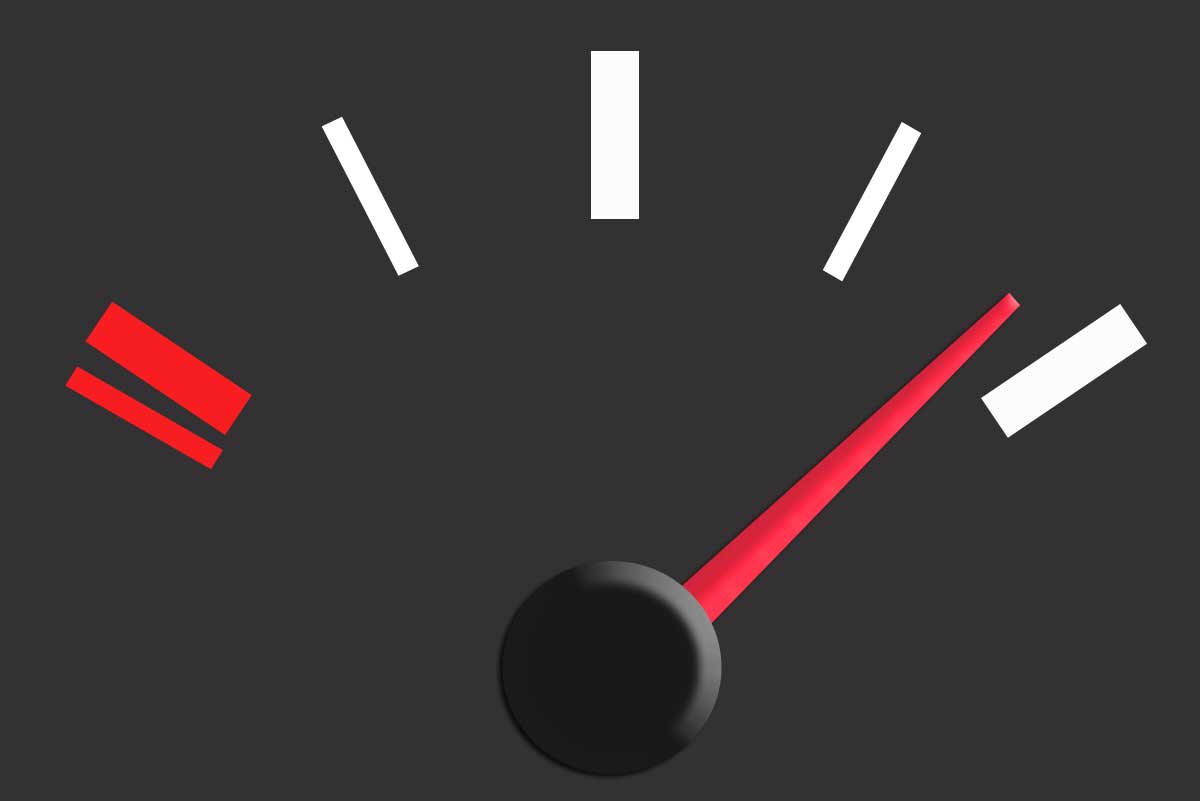

Signs that the Auckland’s housing market resurgence might be flattening out run through out REINZ’s May 2016 data.

It shows that the SuperCity’s median price dropped by 1% (or 0.6% once seasonally adjusted) to $805,000 in May, from $812,000 in April.

While Auckland’s median price rose by 8% as compared to May 2015, the rate of its annual price growth has slowed.

Sales volume in the Auckland region was up 14% as compared to April – but, once seasonally adjusted, the number of sales in the Auckland region fell by 2% on April.

Auckland was also the only region in the country where days to sell increased and, at the same time, its share of auction transactions dropped significantly in May (to 65% from 77% in April).

In contrast, the national median price broke the $500,000 mark for the first time to hit $506,000 in May.

This was an increase of 3% on April and a year-on-year increase of 10%.

It was regional markets, as opposed to Auckland, which drove the national median price up, with five of them reaching new record highs in median price.

Record median prices were reached in Waikato/Bay of Plenty ($419,000), Taranaki ($343,250), Wellington ($465,000), Canterbury/Westland ($435,500) and Central Otago Lakes ($707,250).

But it was the Waikato/Bay of Plenty region that was the leader of the pack.

The region’s median price was up 20% year-on-year to hit a record median sale price for the fourth consecutive month.

REINZ spokesperson Bryan Thomson said that, as 2016 progresses, regional markets are strengthening in both prices and sales volume, while the large main centre markets of Auckland and Canterbury are taking a back seat.

“The confidence led by Auckland is helping to drive demand in regional markets with lower interest rates, easier borrowing conditions outside of Auckland and generally good economic conditions are also contributing.”

Growth in activity across the regions is now exceeding the influence of the Auckland market on national statistics, he said.

“This is shown in the fact that Auckland’s median price is rising slower than the national median price – at 7.5% it is now well below the national median price increase rate of 10% - and Auckland’s share of sales over the past two years has fallen from 40% to 34%.”

However, there is still strong demand across the Auckland region and the listing situation remains very tight, Thomson said.

A dwindling level of listings nationwide is adding to the pressure on markets around the country, he added.

The Auckland market’s quieter month in May attracted the attention of economists.

Westpac senior economist Michael Gordon said the REINZ data showed the country’s housing market had another strong month in May – but it wasn’t driven by Auckland.

ASB economist Kim Mundy said the data showed that Auckland is no longer the sole driving force of New Zealand’s house price growth.

“Tired of being ignored, the regions continue to pick-up pace. Annual median house prices continue to lift in the regions, despite some softening in seasonally-adjusted sales over the month.

“Further, the record new national median high was despite a fall in Auckland house prices.”

However, she said the dip in Auckland prices may only be temporary, as inventory levels remain low and demand high.

“Overall, New Zealand’s housing market activity is increasing strongly on the back of robust demand. Outside of Auckland, low interest rates and displaced Auckland demand is responsible for driving demand.”

Search

Search