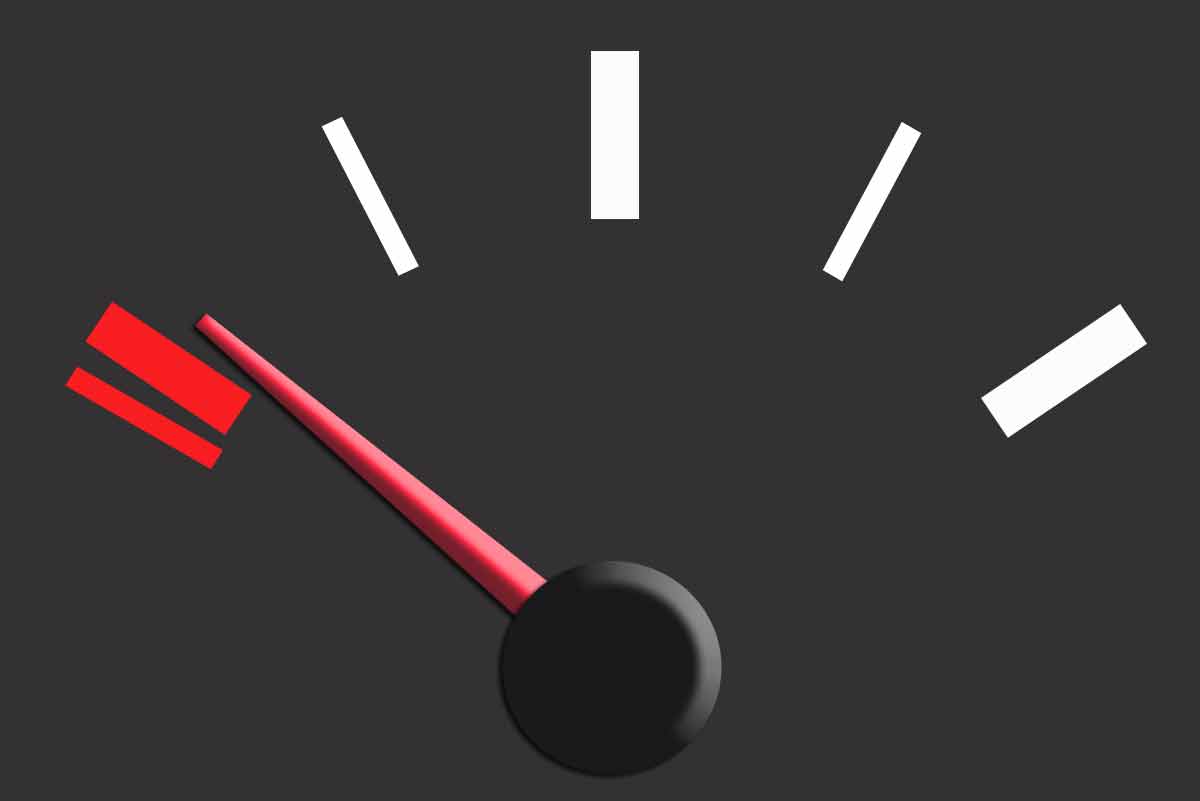

The latest QV House Price Index shows that values in the Auckland region have fallen by 0.5% since December 2015.

This left the average value in the Auckland region at $928,921 in January, as compared to $933,264 in December.

While the Auckland region recorded a 19.8% increase in values year-on-year, over the last three months values have gone up by just 1.2%.

Once adjusted for inflation, values were up 19.7% year-on-year, leaving values 45.2% above the previous 2007 market peak.

QV national spokesperson Andrea Rush said that, for the first time in over a year, values have decreased in former Auckland City Council suburbs, Manukau, Waitakere and on the North Shore.

Traditionally, February and March are the busiest months for the housing market, she said.

“So it will be interesting to see if the downturn is short-lived and if values start rising again over the next couple of months.”

Auckland’s downturn was likely to be a continuation of the softening in the market seen following the introduction of new tax and LVR rules and the restrictions on capital flow out of China late last year, Rush said.

“It’s possible the easing in values may be short-lived as the underlying factors driving house prices up remain: record high net migration, record low interest rates and a lack of housing supply.”

Values continued to rise in outer-fringe Auckland areas like Rodney, Papakura and Franklin, she added.

The decrease in Auckland’s values led to a decrease in nationwide values in January.

They were down by 0.3% from December, which left the average nationwide value at $556,206.

But they have gone up 12.6% over the past year and 0.7% over the past three months.

Once adjusted for inflation, nationwide values have gone up by 12.5%, which leaves them 14.7% above the 2007 peak.

While the nationwide average value may have dropped slightly, values continue to rise in regions around the country.

For example, Wellington values are now accelerating at a pace not seen since before the previous peak of 2007, Rush said.

Values in the capital have risen 4.6% over the past three months and 5.9% year on year, leaving the average value across the wider region at $482,716.

“There is massive interest in Wellington,” she said. “And there’s a shortage of properties listed for sale with listings levels only half what they were this time last year.”

Values in the Hamilton and Tauranga markets continue to rise steadily, while the Christchurch and Dunedin markets also appear to be getting stronger.

Rush said there is good activity and optimism in both the Christchurch and Dunedin housing markets, which continue to see moderate value growth - but at a slower rate than in the capital.

Search

Search