The latest Statistics New Zealand data shows migration continued to break new records in November 2015.

Once seasonally adjusted, there was a record net gain of 6300 migrants in November. This was up from October’s net gain of 6200.

Once again, the net gain was higher than the previous peak of 5700 migrants in July 2015.

Monthly net migration has now been regularly breaking records since August 2014 (4800), when it surpassed the previous highest net gain of 4700 in February 2003.

Statistics New Zealand population statistics manager Vina Cullum said the annual net gain of migrants in the November 2015 year had broken the record for the 16th consecutive month in a row.

Unadjusted figures showed a record net gain of 63,700 migrants in the November 2015 year.

This was due to an increase in migrant arrivals, which were up 11% from the November 2014 year, and a decrease in migrant departures, which were down 3%.

Westpac senior economist Michael Gordon said ongoing low departures and strength in arrivals will cause New Zealand's annual population growth rate to reach its highest pace since 1974.

Net immigration rose further in November, having topped a net 6,000 people for the first time in October, he said.

“The acceleration in the last two months from already-high levels has largely been driven by a drop-off in departures, and to a lesser degree by a pick-up in overseas arrivals.”

Gordon said Westpac expects migration to remain strong for some time, but that it will eventually moderate.

Many people who arrived on student and temporary work visas will start to leave over the coming years, he said.

“In addition, the balance of trans-Tasman job opportunities is now shifting, with Australia reporting strong jobs growth and a lower unemployment rate than New Zealand. If this trend continues, New Zealand will eventually become a less attractive destination.”

In the meantime, migrants continue to flow into New Zealand – particularly Auckland. The SuperCity received a net gain of 29,700 migrants in the November 2015 year.

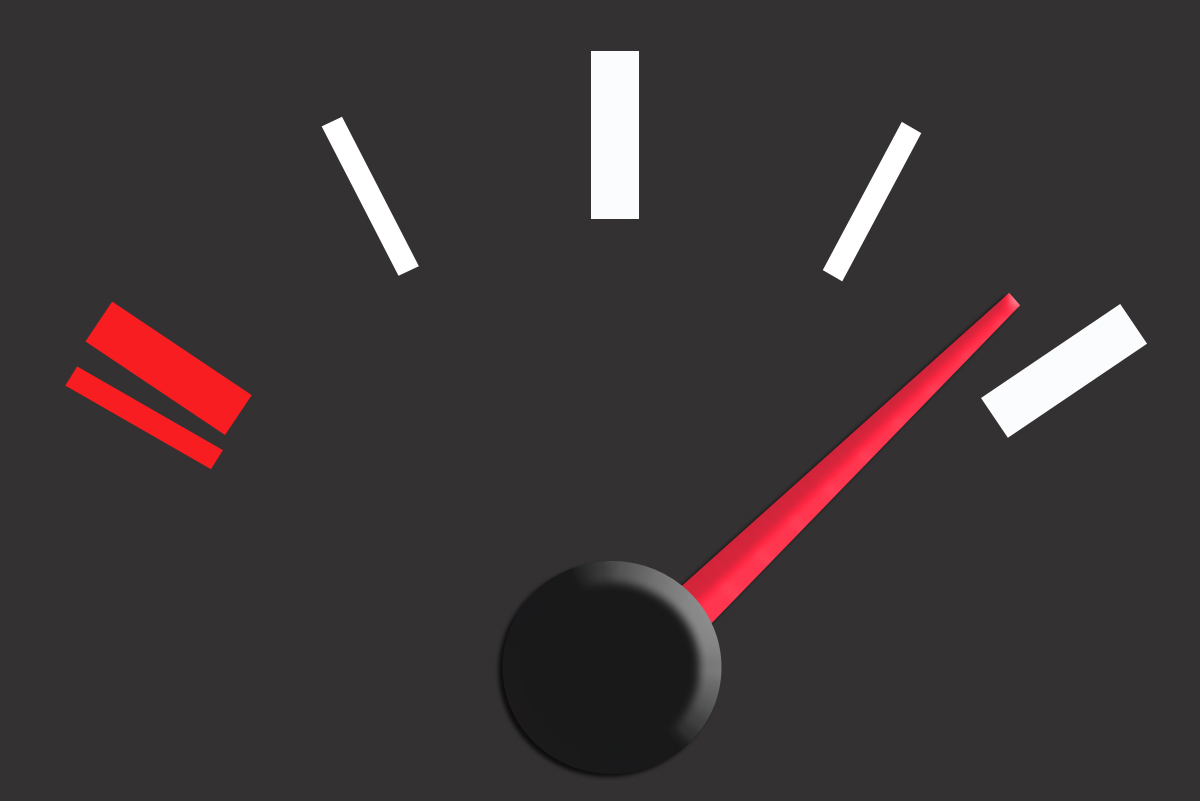

This only adds to the high demand for housing which continues to put pressure on the supply-strapped Auckland market.

![[OPINION] Recessionary times](https://www.goodreturns.co.nz/pics/people/thumbs/300/Gilligan_Matthew_GRA%20New.jpg)

Search

Search