With 8% of respondents nationwide saying it is a bad time to buy, the latest ASB Housing Confidence Survey shows that respondents have become more pessimistic over the last quarter.

It is no surprise that Auckland and Canterbury are the two most pessimistic regions – with 19% and 16% of respondents respectively indicating it wasn’t a good time to buy.

ASB chief economist Nick Tuffley said that higher house prices and limited stock relative to demand are overriding the benefits of low interest rates and weighing on sentiment in both these regions.

At the same time, a majority of respondents (56%) expect house prices to increase over the next 12 months, while only 6% expect prices to fall.

Views on house price growth varied from region to region, with the expectation of higher prices greatest in Auckland (at 63%).

Auckland’s housing market remains very supply constrained at a time when demand is very high, and continued strong upward pressure on prices was to be expected, Tuffley said.

“We expect price appreciation in Auckland will continue to outstrip other regions this year, as strong population growth, low mortgage rates, and tight supply all play their part in this market.”

However, price gain expectations also picked up around the North Island (excluding Auckland) to 54%.

Tuffley noted that, consistent with these price expectations, recent REINZ housing data has showed some signs of a broadening beyond the Auckland-centric theme of the past year.

In Christchurch, 51% of respondents expected house price gains over the next year, while 47% of South Island (excluding Christchurch) respondents expected gains.

This percentage has modified since early 2013 when expectations peaked at 79%.

The change is consistent with the Canterbury market moving back into a more balanced position, Tuffley said.

“House sales reports, listings, and building data have collectively been suggesting that the housing shortages in the region have generally eased over the past year.”

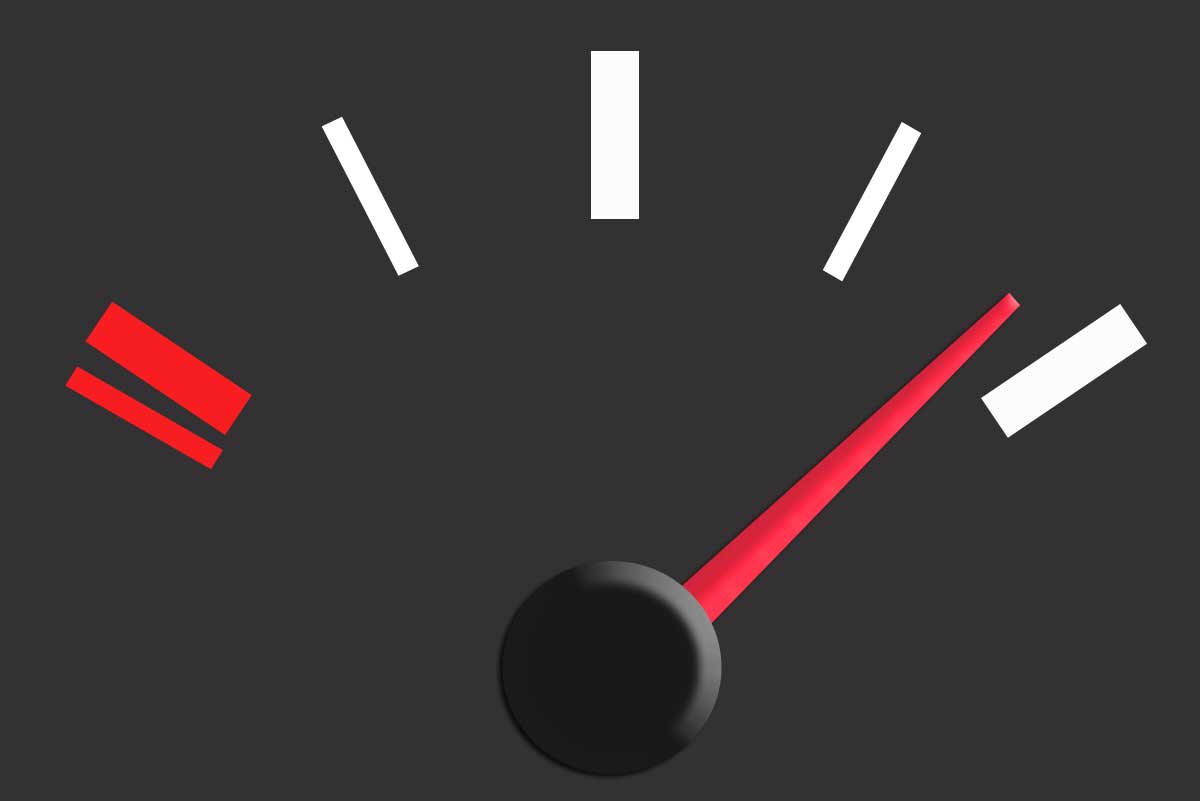

Meanwhile, the survey shows that interest rate expectations have changed considerably.

With the Reserve Bank now signalling that its next OCR move could be a cut, concerns about higher rates appear to be fading.

While 27% of respondents are still expecting higher interest rates over the year ahead, that’s sharply down from the 41% expecting higher rates last quarter.

Those expecting lower interest rates are up to 16% from 6% last quarter.

Tuffley said they are surprised that there haven't been significantly more people expecting interest rates to decrease over the year ahead, given mortgage rates have actually been declining this year.

As speculation over an Auckland “housing bubble” continues, the survey summary says it is hard to dismiss the housing issues as “just an Auckland problem”.

Tuffley said that, over the long term, they expect price growth to moderate significantly.

“More housing supply, rising mortgage rates (as global rates eventually return to more normal levels) and affordability challenges will all have an impact.”

![[OPINION] Recessionary times](https://www.goodreturns.co.nz/pics/people/thumbs/300/Gilligan_Matthew_GRA%20New.jpg)

Search

Search